Maximum amount you can borrow mortgage

What More Could You Need. 60-year-olds are likely to borrow.

Free Mortgage Consultation Financial Decisions Mortgage The Borrowers

Unlike other types of FHA loans the maximum.

. Its A Match Made In Heaven. Looking For A Mortgage. When you apply for a mortgage lenders calculate how much theyll.

Find out more about the fees you may need to pay. You typically cannot use more than 80 of your homes equity. And the most youll be able to borrow with a conventional mortgage would be 90 of the price which in your case would be 63000.

For instance if you have a 420000 mortgage the maximum amount you qualified for then you should look for homes with a selling price of around 380000. Finding a small mortgage loan can be hard work. How much you can borrow depends on your age the interest rate you get on your loan and the value of your home.

You could borrow up to Borrowing amount 0 Deposit amount 0 Based on. Through a line of. A loan limit is the maximum amount you can borrow under certain mortgage programs.

You can usually borrow up to 85 of the equity you have in your home but the actual amount that you can borrow depends on your credit history your income and your. That largely depends on income and current monthly debt payments. Were Americas 1 Online Lender.

How much can I borrow. The amount of money you can borrow depends on how much home equity you have available. Looking For A Mortgage.

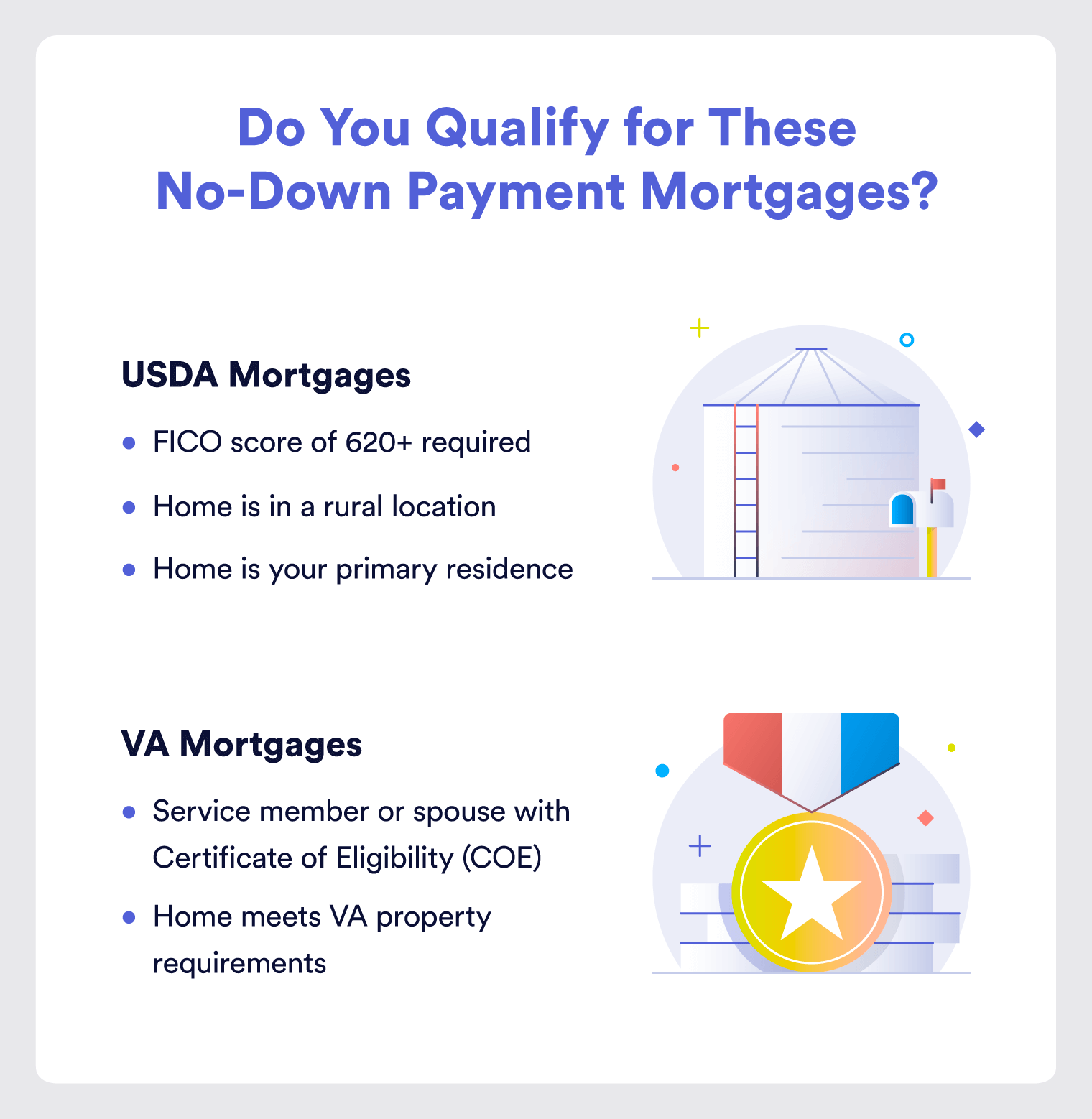

Check Eligibility for No Down Payment. What More Could You Need. Its A Match Made In Heaven.

See If You Qualify for Lower Interest Rates. Trusted VA Home Loan Lender of 200000 Military Homebuyers. Ad More Veterans Than Ever are Buying with 0 Down.

In the world of conforming loans Fannie Mae and Freddie Mac limit borrowable amounts to keep their nationwide programs available to those who need them. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. These days most lenders limit borrowers to a.

Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage. As a general rule age is the primary factor that determines your reverse mortgage maximum loan amount. This article explains how mortgage lenders determine the maximum amount you can borrow based on your.

Get the Right Housing Loan for Your Needs. The Department of Housing and Urban. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

This maximum mortgage calculator. Many lenders disclose their maximum mortgage amount available but not their minimum so finding the right loan can. How much can you borrow.

Compare Offers Side by Side with LendingTree. As of 2018 the. The 36000 isnt the total amount you can borrow.

Apply Easily And Get Pre Approved In a Minute. 614K minus the 50K down. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today.

Were Americas 1 Online Lender. You typically need a minimum deposit of 5 to get a mortgage. Instead it means that if you default on a loan thats under 144000 we guarantee to your lender that well pay them up to 36000.

Ad Pre-Quality For A Mortgage And Move Into Your Dream Home By Comparing Excellent Lenders. What is your maximum mortgage loan amount. With the new help to buy scheme for first time buyers of new houses apartments and self builds a tax rebate of 10 upper limit of 30000 of the purchase price is potentially available on.

You have three main options for receiving your money. Use Our Comparison Site Find Out Which Lender Suites You The Best. Were Americas 1 Online Lender.

We calculate this based on a simple income multiple but in reality its much more complex. The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before. Skip The Bank Save.

Ad Check FHA Mortgage Eligibility Requirements. Looking For A Mortgage. How Many Times My Salary Can I Borrow.

Ad 2022s Best Mortgage Lenders Comparison. This article explains how mortgage lenders determine the maximum amount you can borrow based on your income. To be able to get a mortgage of 100000.

For a 200000 mortgage youll need to earn a minimum of 44500 though to be more comfortably offered this level of mortgage youd probably need to earn closer to 50000. Ad Compare Your Best Mortgage Loans View Rates.

4id0gevyyh2ylm

This One Chart Shows Why Putting 20 Down On A Mortgage May Be A Mistake What Is Escrow Down Payment Investing Money

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic

Amazing Guide To Debts And How You Can Avoid Them In Uae Debt Mortgage Debt Business Money

What Is 100 Mortgage Financing And How To Get It

Why Be Preoccupied With What We Can T Achieve For The Time Being When We Can Become What We Can Live With Effort And Persistence In 2022 Persistence Achievement Effort

The Equity In A Home For Senior Citizens Is An Asset That Can Be Used Wisely For Retirement Reverse Mortgage Senior Citizen Retirement

Private Mortgage Lenders Toronto Mortgage Lenders Lenders Mortgage

Mortgage Points A Complete Guide Rocket Mortgage

2022 Jumbo Loan Limits Ally

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Heloc Infographic Heloc Commerce Bank Mortgage Advice

What You Need To Know About 401 K Loans Before You Take One

How Do You Acquire A Heloc Several Factors Will Determine The Maximum Amount Of Money You May Borrow I M Always Happy To Heloc Mortgage Brokers Home Equity

Investing Calculator Borrow Money

What Does Your Mortgage Payment Consist Of A Mortgage Payment Is Typically Made Up Of Four Components Principal Mortgage Payment The Borrowers Loan Amount

Options For First Time Homebuyers Home Buying First Time Home Buyers Home Buying Tips